THE CURRENCY FUND

| Net Asset Value: | 10.26 |

|---|---|

| Trade Time: | Aug 6 |

| Change: | |

| Prev Close: | 10.30 |

| YTD Return*: | N/A |

| Net Assets*: | 8.04M |

| Yield*: | N/A |

* As of 30-Jun-09

| Net Asset Value: | 10.26 |

|---|---|

| Trade Time: | Aug 6 |

| Change: | |

| Prev Close: | 10.30 |

| YTD Return*: | N/A |

| Net Assets*: | 8.04M |

| Yield*: | N/A |

* As of 30-Jun-09

The foreign exchange market (currency, forex, or FX) trades currencies. It lets banks and other institutions easily buy and sell currencies. [1]

The purpose of the foreign exchange market is to help international trade and investment. A foreign exchange market helps businesses convert one currency to another. For example, it permits a U.S. business to import European goods and pay Euros, even though the business's income is in U.S. dollars.

In a typical foreign exchange transaction a party purchases a quantity of one currency by paying a quantity of another currency. The modern foreign exchange market started forming during the 1970s when countries gradually switched to floating exchange rates from the previous exchange rate regime, which remained fixed as per the Bretton Woods system.

The foreign exchange market is unique because of

As such, it has been referred to as the market closest to the ideal perfect competition, notwithstanding market manipulation by central banks. According to the Bank for International Settlements,[2] average daily turnover in global foreign exchange markets is estimated at $3.98 trillion. Trading in the world's main financial markets accounted for $3.21 trillion of this. This approximately $3.21 trillion in main foreign exchange market turnover was broken down as follows:

As in the Black-Scholes model for stock options and the Black model for certain interest rate options, the value of a European option on an FX rate is typically calculated by assuming that the rate follows a log-normal process.

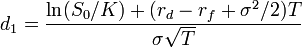

In 1983 Garman and Kohlhagen extended the Black-Scholes model to cope with the presence of two interest rates (one for each currency). Suppose that rd is the risk-free interest rate to expiry of the domestic currency and rf is the foreign currency risk-free interest rate (where domestic currency is the currency in which we obtain the value of the option; the formula also requires that FX rates - both strike and current spot be quoted in terms of "units of domestic currency per unit of foreign currency"). Then the domestic currency value of a call option into the foreign currency is

The value of a put option has value

where :

In financial markets, the retail forex (retail off-exchange currency trading or retail FX) market is a subset of the larger foreign exchange market. This "market has long been plagued by swindlers preying on the gullible," according to The New York Times[1]. Whilst there may be a number of fully regulated, reputable international companies that provide a highly transparent and honest service, it's commonly thought that about 90% of all retail FX traders lose money. [2] [3]

It is now possible to trade cash FX, or forex (short for Foreign Exchange[4] (FX)) or currencies around the clock with hundreds of foreign exchange brokers through trading platforms. The reason that the business is so profitable is because in many cases brokers are taking the opposite side of the trade, and therefore turning client capital directly into broker profit as the average account loses money. Some brokers provide a matching service, charging a commission instead of taking the opposite site of the trade and "netting the spread", as it is referred to within the forex "industry."

Recently forex brokers have become increasingly regulated. Minimum capital requirements of US$20m now apply in the US, as well as stringent requirements now in Germany and the United Kingdom. Switzerland now requires forex brokers to become a bank before conducting FX brokerage business from Switzerland.[citation needed]

Algorythmic or machine based formula trading has become increasingly popular in the FX market,with a number of popular packages allowing the customer to program his own studies.

The most traded of the "major" currencies is the pair known as the EUR/USD, due to its size, median volatility and relatively low "spread", referring to the difference between the bid and the ask price. This is usually measured in "pips", normally 1/100 of a full point.[citation needed]

According to the October 2008 issue of e-Forex Magazine, the retail FX market is seeing continued explosive growth despite, and perhaps because of, losses in other markets like global equities in 2008.